A property in Spain often looks very affordable at first glance. But don’t be misled: the purchase price is only the beginning. To be truly prepared, you also need to account for a number of additional costs — legal, practical, and strategic. Here are the most commonly underestimated expenses you should be aware of in advance.

1. Transfer taxes and registration fees — or VAT and AJD

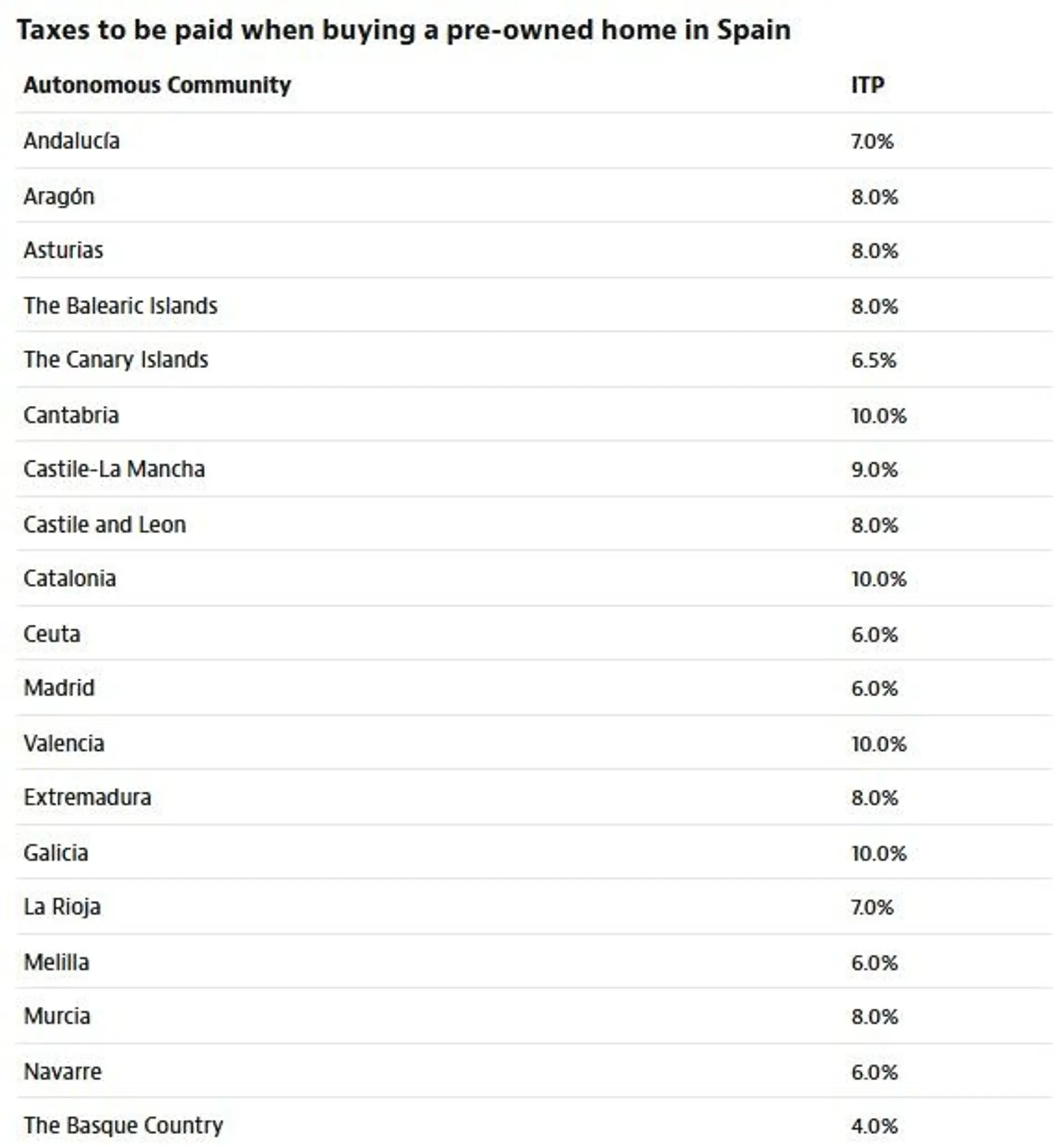

In case of a resale, you’ll need to pay transfer tax, notary fees, and land registry costs. These vary depending on the region: a certain percentage is added to the purchase price, plus notary and registration fees.

When buying a new-build property, you’ll always pay 10% VAT, along with the AJD (stamp duty), which is also region-specific and charged as a percentage of the purchase price.

For new properties intended for tourist rental, VAT goes up to 21%. We’ll explore that specific case in a separate article.

2. Legal support fees

It is strongly recommended to work with an independent lawyer or gestor. They will check the legal status of the property, help you avoid legal pitfalls, and follow up on the administrative process. Expect to pay between €1,000 and €2,500. This may increase if you also require services such as NIE application, a power of attorney, or utility setup.

3. Financing costs (if taking out a mortgage)

Planning to take out a Spanish mortgage? Then you’ll face additional costs: property valuation, bank fees, and file opening costs. On average, this amounts to 2–4% of the loan amount. You may also choose to work with a mortgage broker. More info: www.luxelitefinance.com

4. Translation, power of attorney, and NIE

For official procedures, you’ll often need sworn translations, a Spanish tax ID (NIE), and sometimes a notarised power of attorney. These are not major costs, but they often come unexpectedly.

5. Community fees (in apartments or gated communities)

If the property is in a residence or urbanisation, you’ll pay monthly or quarterly fees for shared services such as garden maintenance, swimming pool, elevator, lighting, etc. Sometimes just €40/month, sometimes several hundred.

6. Annual taxes and levies

The annual Spanish property tax (IBI) is easily overlooked. It depends on the local municipality and cadastral value. Waste collection fees or even a tourist tax may also apply in certain areas.

7. Advisory or support fees

If you work with a Belgian property advisor or partner in Spain, you may pay additional fees — but this often saves you from making costly mistakes, wasting time, or facing legal risks. The real cost is often not working with the right support.

🎯 Conclusion

These costs are no secret, but they are often underestimated. Being well-informed helps you avoid surprises and make better decisions. Always ask for a full cost estimate upfront — not just for the property itself, but for the entire buying process.